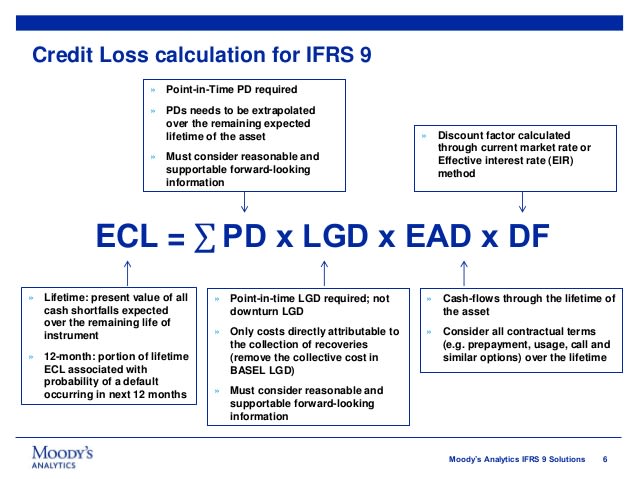

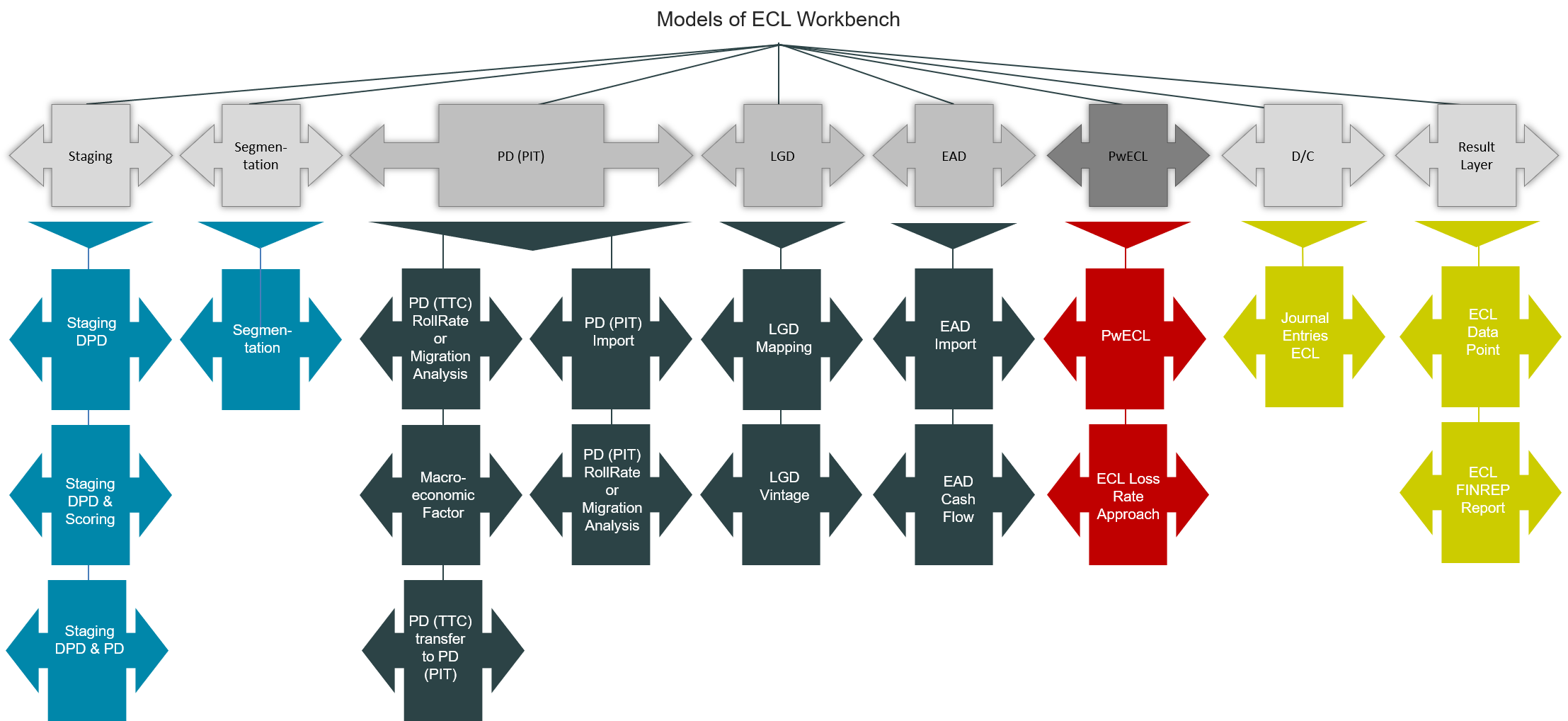

IFRS 9 Blog Series: Tackling the Challenge of Calculating Impairment | S&P Global Market Intelligence

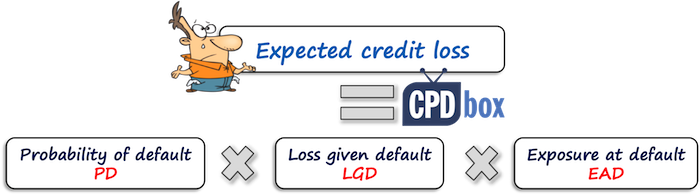

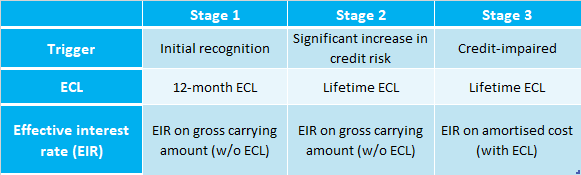

IFRS 9, simplified approach for trade receivables, policy, judgements and estimates and disclosures including credit risk – Accounts examples

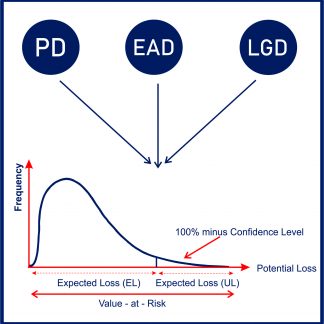

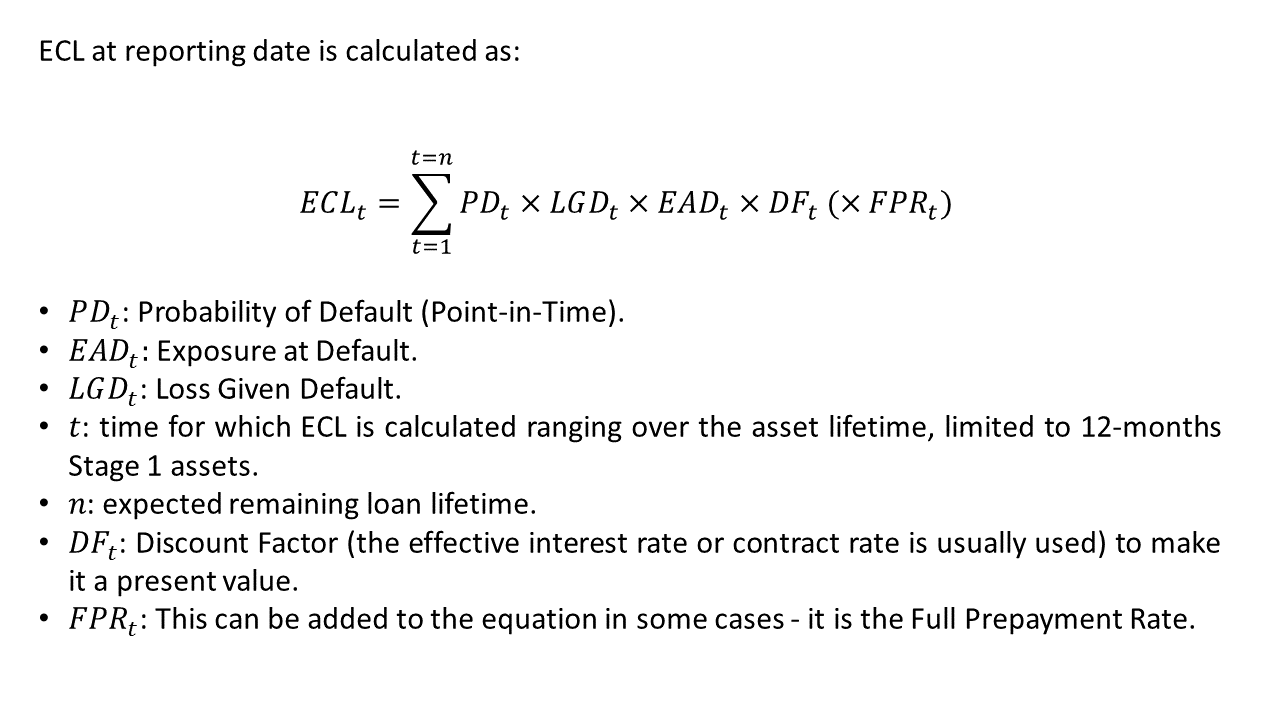

An Introduction to Credit Risk in Banking: BASEL, IFRS9, Pricing, Statistics, Machine Learning — PART 2 | by Willem Pretorius | Medium